Today we are busting open some business money myths that could be holding back your brand with Silvia Manent, Founder and Managing Partner of Manent Capital, a Boston-based wealth management firm that manages over $70 million.

I am so excited to dive into building wealth within your brand and business.

If you’re not using debt to your advantage, you’re leaving a lot of money on the table.

– Silvia Manet, Manent Capital

Here’s what you can expect to hear in this episode:

- Silvia’s journey into working in wealth management

- How money and managing money tied to your brand’s success

- 5 money myths about the ultra-wealthy that we need to set straight

- What every brand be looking at when it comes to their finances

Resources Mentioned In

This Episode

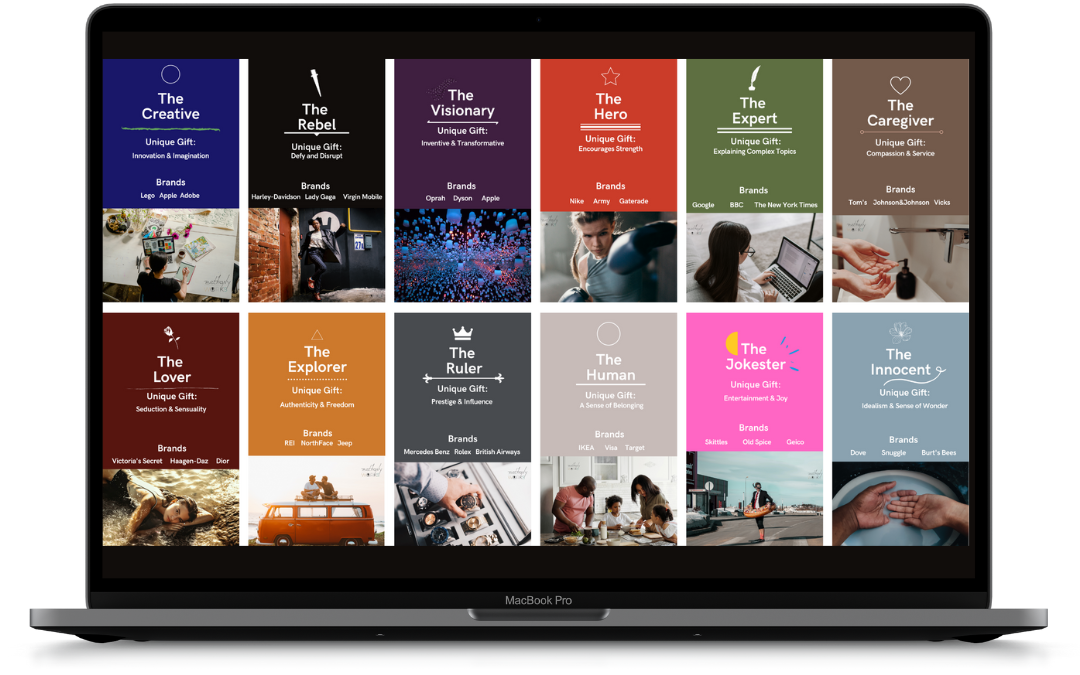

Take The Brand Quiz To Unearth Your brand personality

Pop over to our brand and web design agency and take the free brand personality quiz to begin diving into your brand persona.

can you tell me a little bit about who you are and how you came to be working in wealth management?

Yes. So I actually grew up in Spain, and you might be able to hear me from the accent. Long story short, I moved to the United States when I was nine.

From a very young age, I knew that I wanted to make money. I didn’t know how at the time, I thought I was going to do artificial intelligence when I was nine. Tthen I ended up going into finance. Somehow it ended up now I’m back into artificial intelligence… I use it all the time.

But basically, after I graduated from college, I went and worked for Credit Suisse with Mexican clients. So really ultra-high net worth individuals. I mean, we’re talking about $50 million, and up; most of our clients had a net worth of around 300 million at the least. They were really big billionaires.

That’s when I got a taste of what it really was like to have ultra wealth. I moved back to the United States in Boston, where my family was from just sort of working with more “normal” people. And normal people like one to 2 million, that’s not even normal. I noticed very big gaps between the very ultra-wealthy and the wealthy, which we’re going to talk about today.

How is money and managing money tied to your brand’s success?

I think as women, especially as women, and but in general, I think if we’ve come from a lack of money, it’s very hard for us to invest in our brands, in our business, and in ourselves because we don’t truly have the confidence to believe in our abilities.

That is just one of the things that I really truly saw in these ultra-high net worth clients that have $300, $400, $500 million is that they truly believe in their abilities to build new businesses, build new brands. That’s something that I don’t typically see with people that are starting out, especially women, we have a very low confidence in general.

If I were to generalize things, most of my clients are women. Fifty percent of the people that come to me are men, even though my website says I work with women. They come to us because I think men are much more confident in their abilities. Even if they don’t have all the same skills as someone else, they will apply for a job. That’s typically what I saw with the ultra-wealthy as well.

5 Money Myths About The Ultra-Wealthy That We Need to Set Straight

MYTH #1: Get a high-paying job, and don’t rock the boat

The number one myth is that you need to, especially after college, go out and get a really nice high-paying and investment banking job at McKinsey or they’ll work out paying their workers all these nice fancy works. But the reality is that the wealthy are just going and doing a W-2 job just to get experience.

A lot of the time people will create careers just by having a W-2 job and working for 10, 15, or 20 years in that same job, and they’ll become a managing partner at this company. But a lot of times what I would see with the ultra-wealthy, especially their children, is they would go two to three years, you know, maybe work for Morgan Stanley, McKinsey, maybe five years just to get that experience, but then they will go, and either work for the family business, or they will actually start their own businesses.

So most of the people will actually end up starting their own businesses because that’s truly the only way to really create substantial wealth, which is a big myth, right? We’re always just taught to get a high-paying job. A lot of the times, really, the kids of these ultra-wealthy individuals, they ended up getting $80,000, you know, starting jobs, maybe they weren’t making $200,000 off the bat out of college like some of the other people did.

But they got that experience, and now they’re doing way better than a lot of people that just stayed at their jobs and tried to have a high income. So I think that’s the number one myth is don’t rock the boat, and just stay in your own path, kind of do your own thing versus starting your own business and taking that risk, because the biggest risk is not to take any risk at all. That’s really the big mindset that wealthy people have versus not.

MYTH #2: pay off all your debt, then you can really start to build wealth

This is a big one. We tend to hear it a lot.

For those of you that don’t know, Dave Ramsey is like a financial guru that is on the radio, just talking to normal people every day. One of his myths, and in general, this is something that we hear a lot, is don’t invest unless you pay all your debt, right? Or don’t, you know, pay off all your debt, and then you can really start to build wealth.

That is nothing but nothing further from the truth. In fact, the wealthiest people were the ones asking for debt, asking for lines of credit, right? This $300 million client that I had that I was servicing all day long, they were negotiating with me, Silvia, can you can I get a better rate on this line of credit, can I get a better rate on this other loan, and they were always trying to use the bank’s money to invest in their own business, as they were happy to have a balance of debt.

If you have $100 million, you probably shouldn’t take more than 30 to $50 million of debt that’s 30 to 50% of your net worth. But having debt on a balance sheet is actually healthy, especially if it’s low interest. You can negotiate some good interest rates, because if you’re not using debt, and this is obviously at the end of the day, it’s going to be your preference. But if you’re not using that to your advantage, you’re leaving a lot of money on the table that you’re otherwise losing and that the banks are making.

So I think that’s the number one misconception is a lot of people and especially women, I see this all the time where we’re so focused on just paying off your debt, getting that off the balance sheet. But here’s the thing, if you can borrow, let’s just say you borrow debt at 3%. But you have a return on your investment that’s higher than 3%, which typically if you have a successful business, you’re probably going to have like a 20-30 times return. That’s good. Don’t pay off that debt.

You know, keep it there, grow your business with that bank’s money, because that’s helping you generate even more money. The thing about it is that as women, generally we’re not taught that way. We get very scared because we don’t understand how it can actually help us. But the reality is that having a little bit of debt is totally healthy as long as it’s manageable.

As long as you’re actually buying debt to either invest in something that produces income, either real estate or a business, or the stock market, whatever it is, and you always should negotiate your debt, which is something that I don’t see, a lot of normal people do.

MYTH #3: you need to DIY to save money

Wealthy people hire experts to get their stuff done. This is something that I think I see a lot, especially with women, and I’m saying this session with women because I feel like this is the reason why I think we have the glass ceilings is that we have all these poor money thoughts in our brains from an early age. We’re very obsessed with DIY to save money.

I remember I was so proud, like two years or three years ago, when I first started my business. I was so proud. I just built this amazing website; the website was really shitty, by the way. I built it on my own; it only took me three months, right? Well, long story short, my website was really crappy. I had no lead generation because it didn’t create any trust. But I was so proud because I was like, I just saved like five grand.

My dad, I’ll never forget that he’s like, you didn’t save five grand. What was the opportunity cost of that decision? Like, how much money did you leave on the table because you don’t have a good presence online? Because maybe you don’t hire an expert to do your taxes, and possibly they could have saved you $20,000 on your taxes or $30,000. I had someone tell me that I saved them $50,000 on their taxes.

I’ve been in that situation where I was like, oh, I need to be so frugal. Let me do it DIY. Let me just learn it on YouTube and do it myself. But it’s like; there’s so much money that I left on that. Once I actually had a real website done, I started getting so many leads, and it paid for itself within a week.

We think too much about saving money. That’s a poor money mindset or poor people mindset, we think so much about saving money, we don’t see the opportunity cost of our action, right? What’s the opportunity cost of having Bethany do your website and getting more leads and possibly, you know, being able to present yourself in front of people?

What’s the opportunity cost of not hiring a financial advisor and losing 1000s of dollars buying cryptocurrency and trading stocks? People come to me after they lost money because they’re like, I realized that I need an advisor after losing all this money to technology and all this stuff. Cheap things can become expensive in the long run.

MYTH #4: pay your expenses quickly & payment plans are bad

This is another myth that I tend to see a lot. How many times have we heard, hey, this bill is due in September; just have the cash in the bank. Let me just pay it off, and I’m gonna pay it off in full because I have all of it.

Number one, if a bill isn’t due until September 30, pay it by September 29. I mean, make sure that you’re not late, but there’s no reason for you to pay, like give someone a free loan for three months, unless they’re giving you a discount, right? If a client pays ahead of time, I’m gonna give them a discount, right?

The second thing is don’t do payment plans; payment plans are bad. Not necessarily. And let me tell you why.

So there are a few reasons why I actually like payment plans versus paying things in full for two reasons.

Number one, sometimes the interest rate on a payment plan may not be that high. Typically, what I like to do is just figure out the calculation. The easiest way to figure out the interest rate on a payment plan is to use an online calculator, just put typing on Google interest rate or payment plan calculator, or use chatGPT.

If the interest rate is less than 8%, or, you know, maybe six 6%, something less than that, a payment plan is probably better.

Number two is, especially if you don’t know someone, maybe you’re taking a chance on someone, who’s new, they have like no reviews, there’s just nobody that really knows, it will allow you to pay so that you don’t give them all your money right away. Obviously, if you pay with a credit card, it’s a lot safer because you get the points, but it’s a lot easier to pay things step by step and see if they are delivering on their promise.

This is something again that I did so when I started my business. I decided to pay for the Wing. So the Wing was an all-women office here in Boston, New York, Chicago; it’s like this amazing up-and-coming workspace. I was super excited. There were two girls CEOs; they look amazing.

So I paid in full because I got, you know, a $200 discount, but I didn’t even check the interest, and it wasn’t even that high. So I paid everything in full. Two months later, they went bankrupt because of COVID. Then I didn’t have my money back.

Again, I remember talking to my dad; he’s like your money should always be close to you. This is something his boss, who was a billionaire at the time, always did, right? Keep your money close to you always; know where it is. Don’t give it away quickly. If you can do a payment plan, sometimes that’s better, especially with a lot of these online scams out there.

I just feel like with social media; there are just a lot of fake gurus. So it’s really scary to know what’s real and what’s not, especially with a lot of business masterminds that are like $20-, $30-, even $50,000. It’s a lot of times an ego thing; we want to show that we do have the money and that we are successful. But a lot of times, the most successful people have actually asked for payment plans from me. I was like good for you, good job. You’re being really smart with your cash flow.

That is just the number one thing as an investor as a business owner if you don’t have healthy cash flow in your accounts, and I typically recommend that everybody keep at least three months, preferably more like six months of your business cash flow. If you’re spending $5,000 monthly on your business, you should have between $15 to $30,000 in your bank account.

MYTH #5: BUDGETING IS FOR POOR PEOPLE

Rich people don’t call it budgeting. They call it a cash flow forecast. So you can change the word if budgeting gives you hives; they rebranded it. You have to know exactly how much money you’re spending on your business. Like there’s just no way, you can’t go on with knowing how much I know exactly my fixed expenses in my business are $15,000 a year.

If that year, I’m going to do a lot of Facebook ads, I’m going to hire coaches, I’m going to redo my website, then I up it a little bit more. But I know exactly how much money I’m spending in my business. Then I look at what I’m expecting for cash flow. Make it a habit, at least, especially if you’re a business owner. Please have a spreadsheet or at least use QuickBooks. I know QuickBooks is ugly, but it’s so helpful if you do it well and you can actually analyze your numbers.

What does every brand need to have, no matter where you’re at on your journey?

First, get a CPA and bookkeeper, and then I would say the financial advisor, then an estate planner; you’d like to have a loan officer if you’re going to be doing a lot of real estate. They always say it’s a lot easier to get a job when you have a job. So it’s a lot easier to get funding when you don’t need funding.

So start to create the network early on, you know, talk to bankers at JP Morgan even though it’s a large branch. Go into a branch and be friends with people; nobody does that anymore. So it’s a great way to and also everyone wants to get out of the house. So do it.

What is a fatal business financial mistake you see all too often in the entrepreneurial space (that you didn’t already mention)?

You can do everything right – First Republic, is great, great, great example. First Republic, for those of you that don’t know, was an amazing bank that caters for ultra-high net worth clients; you had to have at least one to 2 million to bank there. They were at the top of the world.

And overnight because people lost trust in the banking system, they lost all their clients. Let me tell you that bank, every single client of theirs was so happy to bank with the First Republic; they were super happy, they got amazing rates. But overnight, people will pull their money as soon as they lose trust.

JP Morgan now owns this company, at no fault of their own. But if you break the trust of someone, whether it’s because you’re promising people on a sales page things and you don’t deliver, you tell someone that they have lifetime access to a course, then you take a course away. You have lost trust; you will get hate from people.

I just have to say like, nowadays, one happy customer will tell one other customer but one angry customer will tell all the social media followers or Twitter followers, so don’t piss people off and have integrity.

silvia manent bio

Silvia is the Founder and Managing Partner of Manent Capital, a Boston-based wealth management firm that manages over $70 million and focuses on helping professionals understand their personal and business finances so that they can feel accomplished, confident and excited about investing in their future dream goals. She has over 10 years of investment and wealth management experience, including individual investment management, comprehensive financial planning and high net worth advisory.

Prior to founding Manent Capital, Silvia worked as a financial advisor at Morgan Stanley where she was responsible for providing clients with personalized plans to help them better manage their investments, cash flow and achieve their financial goals. Prior to this, Silvia worked with international ultra-high net worth clients at Credit Suisse in Zürich, Switzerland as well as J.P. Morgan in Boston, MA. Silvia began her career in Palo Alto, CA at Cepheid, a leader in molecular diagnostics and Instrumentation Laboratory (IL), a leader in critical care, hemostasis and point-of-care diagnostics.

Silvia received her undergraduate and master’s degree in Finance and International Management from ESADE, a Top-Ranked European Business School. Silvia is a Chartered Financial Analyst (CFA®), the highest distinction in the investment management profession as well as a Certified Financial Planner (CFP®), the standard of excellence in financial planning. In addition to understanding the complexities of the changing financial climate, Silvia is held to the most rigorous ethical standards by both designations.

Silvia speaks English, Spanish, French and Catalan.